As Carlos Torres Vila, the head of BBVA, set out why the Spanish lender planned to take full ownership of Turkish bank Garanti, it did not always sound like the sales pitch typically rolled out for corporate deals.

But then the 55-year-old BBVA chair could hardly ignore the backdrop to the transaction — years of erratic economic management and turbulent politics under Turkey president Recep Tayyip Erdogan.

“We have seen recurrent crises, spiralling inflation and depreciation of the currency, and we have suffered that in our flesh and blood, through devaluation of our invested amount,” Torres said on Monday, as BBVA announced plans to pay €2.25bn for the remaining 50 per cent of Garanti, in which it has been building a stake since 2011.

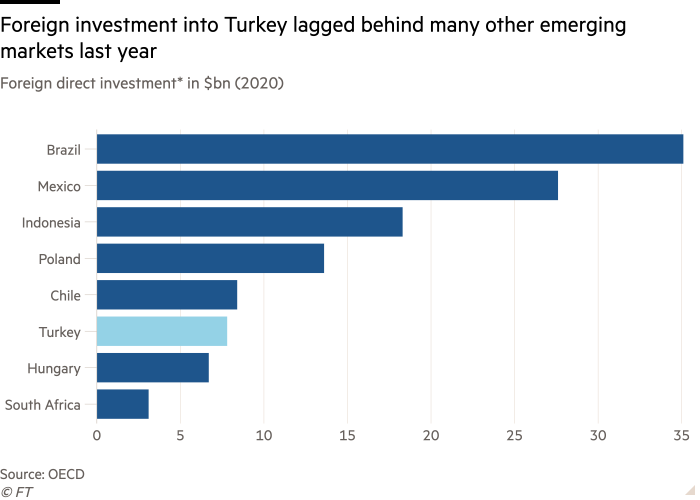

The BBVA bid, which would be one of Turkey’s biggest single foreign direct investments in recent years if shareholders and regulators approve it, buoyed the country’s stock market. But BBVA shares closed down 4 per cent, with analysts at Citigroup describing the deal as “risky”.

Despite the euphoria over the deal in Istanbul, business executives and analysts cautioned it was too early to declare whether the move would herald more investment in a country whose strategic location and 83m-strong population has long held great promise for foreign companies.

“Most western investors see the political risk in Turkey as too high right now,” said Jonathan Friedman, an analyst at Wallbrook, a global risk and ESG consultancy.

Instead, the BBVA deal fits into a pattern familiar to foreign diplomats in Turkey: while new entrants remain deeply wary, some of those companies with a longstanding presence are prepared to increase their commitment.

Torres hailed the chance to capture the rest of Garanti as a great deal, in part because of the Spanish bank’s intimate knowledge of the Turkish lender, which was already largely consolidated in BBVA’s accounts.

“At these prices the risks are priced in,” he told analysts. “We know the asset well, we’ve run it for a decade, we’ve seen how in crisis situations it operates and generates euro returns.”

Over the past five years Garanti had generated an average of €1.2bn to €1.3bn in net profits a year, he added — even though the Turkish lira has tumbled more than 70 per cent against the euro since the start of 2016.

The currency sank further on Thursday after the central bank slashed interest rates, defying warnings from investors that the move would further fuel inflation. The decline in the lira was steep enough to drag on BBVA shares, which closed 5.5 per cent lower.

Ahmet Burak Daglioglu, head of the Turkish government’s investment office, which is tasked with attracting foreign capital, insisted that “the risk perception of those outside Turkey is higher than those inside Turkey”.

It is a view echoed by Cavit Habib, chief executive of the Turkish division of Danish services provider ISS, which has been in the country for 16 years and this year acquired a local facilities management company. “Being here and looking at things from the outside are totally two different things,” said Habib.

Nor is BBVA the only foreign company willing to stomach the macro turmoil. Ford Otosan, a partnership between the US carmaker and Turkey’s largest conglomerate that dates back almost a century, announced in March plans to invest €2bn over the next five years.

Huhtamaki, a Finnish producer of sustainable packaging that first entered Turkey in 1997, acquired local company Elif Plastik for €412m in September. “It’s not a new market for us. That makes it easier,” said Katariina Hietaranta, a Huhtamaki official, adding that the fact that the majority of its sales were exports “helps a lot to mitigate the currency risk”.

However, international companies already in Turkey are not blind to the dangers, including a steady erosion of democratic freedoms and the rule of law. One foreign executive said he lives in fear of being hit with some “horrible, politicised” tax ruling that could result in a large fine. “It’s not just that it drags on in the courts, but that you will never successfully appeal it,” he said.

Erdogan’s determination to prioritise growth at all costs, and relentless interference in the central bank, has hammered the lira while leaving Turkey mired in a boom-and-bust cycle. Although the IMF forecasts the economy will grow by about 9 per cent this year, that expansion has come with an inflation rate running at 20 per cent.

The corporate departures from Turkey in recent years have been notable, including Japanese carmaker Honda and the US home appliance maker Whirlpool. UniCredit, Italy’s second-largest bank, joined them this month, announcing plans to sell its remaining 20 per cent stake in Turkish lender Yapi Kredi in 2022.

Andrea Orcel has set about simplifying UniCredit’s global footprint since joining as chief executive in April. The decision to dispose of its stake in Yapi Kredi was part of that strategy, with UniCredit selling off minority holdings in countries where it does not have a significant presence.

But a person with knowledge of the bank’s plans said the relative lack of liquidity in Turkey’s capital markets, combined with political uncertainty in Ankara, played a part in UniCredit’s decision.

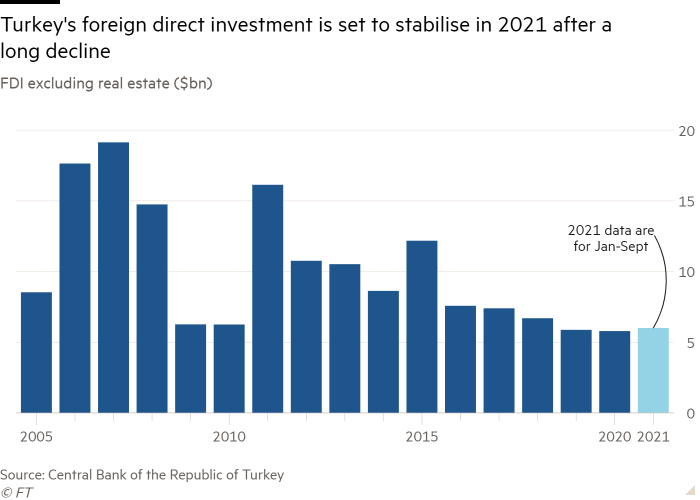

Turkish officials say that foreign direct investment figures for this year will improve on the levels seen in 2019 and 2020, when they languished at 15-year lows, with the country’s growing tech sector helping.

Tech start-ups, often based in Istanbul, have defied the gloomy trend as venture capitalists, private equity firms and sovereign wealth funds pour money into the likes of Getir, a delivery app, and Trendyol, an ecommerce site.

Turkey bulls also point to the growing confidence among opposition parties that Erdogan could be forced from power in elections that are due in 2023, but could take place sooner.

“The consensus view is that all Turkey needs is for one man to retire and the country could be off to the races,” said Charles Robertson of Renaissance Capital, the emerging markets-focused investment bank.

Yet analysts like Friedman at Wallbrook said betting that the worst was over remained a huge gamble. He added: “Investing on the upswing is always seen as lower risk than trying to time the bottom.”

Additional reporting by Owen Walker in London

"follow" - Google News

November 20, 2021 at 06:00PM

https://ift.tt/3cunFUW

Few dare to follow as Spanish bank BBVA lifts bet on Turkey - Financial Times

"follow" - Google News

https://ift.tt/35pbZ1k

https://ift.tt/35rGyU8

Bagikan Berita Ini

0 Response to "Few dare to follow as Spanish bank BBVA lifts bet on Turkey - Financial Times"

Post a Comment