Kwarkot

Many articles on SA feature a macroeconomic prediction of some sort. This then supports investments that the author believes will benefit.

Howard Marks has noted this, in Thinking About Macro, saying “Many investors think their job requires them to develop a macro outlook and invest according to its dictates.”

Marks goes on to observe:

- Most macro forecasts are likely to turn out to be either (a) unhelpful consensus expectations or (b) non-consensus forecasts that are rarely right.

- I can count on one hand the investors I know who successfully base their decisions on macro forecasts.

- It may be hard to admit – to yourself or to others – that you don’t know what the macro future holds, but in areas entailing great uncertainty, agnosticism is probably wiser than self-delusion.

The fundamental reason why such forecasts fail often is that macroeconomic developments involve the interplay of innumerable causal forces reflecting the decisions of innumerable individuals. And on top of that the motivations, incentives, and rationality of these individuals vary greatly.

The outcomes of these processes are inherently not predictable. Whether one looks at US economic recessions, stock-market movements, oil-price movements, or many other things, one cannot forecast the macroeconomic future with any accuracy.

Yet at times there are clear reasons to think one knows something about aspects of the near-term future that does not depend on the messy interplay just described. In my view now is such a time, and it opens up investment opportunities.

But the knowledge is narrow and the outcomes are not certain. Let me explain.

The Next Phase of Measured Price Inflation

My view is that future inflation rates are fundamentally not predictable in detail, for the reasons given above. There are some large-scale causal relations that at times can help you, if you understand them.

As one example, if a government distributes a massive amount of “helicopter money,” this will produce a burst of price inflation. This is the story of recent years in the US.

Even there, how much of that money would be saved and when it would be spent were uncertain. And even that burst of inflation could have been quenched by a sufficiently strong economic collapse, with the associated destruction of money by the extinguishment of debt.

But though we do not know how future inflation will develop, we can say something about measured inflation. The Consumer Price Index for All Urban Consumers, or CPI-U, has numerous categories.

What matters for the near future is the “Shelter” category, measuring housing costs. This composes about a third of the total index and 60% of the “core” index. Its impact misleads intelligent investors and idiot commentators alike.

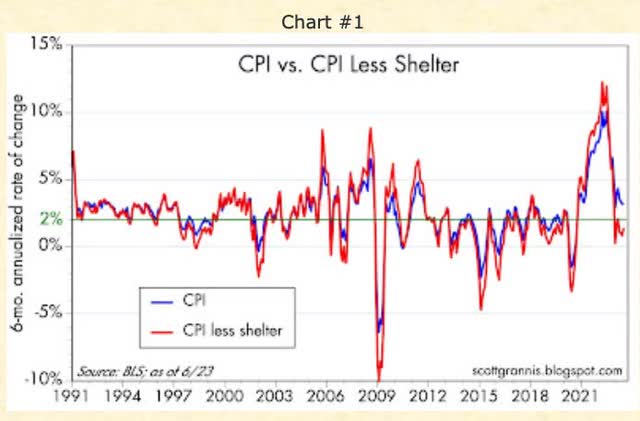

Here is a chart from economist Scott Grannis:

Scott Grannis

He had this to say about it

Chart #1 shows the 6-mo. annualized change in the CPI (3.3%) and the CPI less shelter (1.4%), with the green line representing the Fed's 2% target. If it weren't for shelter costs, which are being artificially inflated (housing prices and rents are flat to down in the past year or so, but the measure of those costs is delayed by more than a year by the methodology the BLS uses), then inflation right now is well under the Fed's target.

The difference between the two curves is about 2%. This is close to the current rate of increase of the BLS “Owners Equivalent Rent” times the 34% contribution of that component to the index.

If you follow Hoya Capital, you’ve seen the same point made repeatedly. He had this to say about the most recent CPI print:

... in June shelter inflation accounted for 85% of the overall increase in the year-over-year headline CPI figure and 65% of the month-over-month increase.

Another way to put the point is that the structure of the calculation of the CPI-U index, combined with information about the recent past, definitively implies that the (core) CPI-U will drop rapidly over the next several months.

This is neither a speculation nor a macroeconomic forecast. It will happen.

The only way to get a different outcome would be to have an unprecedented explosion in non-housing costs appear out of nowhere. In my view, this is sufficiently unlikely over the next year as to be ignored. The necessary monetary support is not there and overall debt levels are not exploding.

The Reaction by the Fed

The next question, in the context just described, is how the Federal Reserve will react. The Fed will react by cutting interest rates, in my view.

I see near zero chance that the Fed will ignore CPI prints below 2% just because it has not “finished the job” of killing the labor markets. Deflation is the number one fear of central bankers, and for good reason.

This is a forecast of the behavior of the Fed, a limited number of individuals with relatively comprehensible incentives and motivations. It is not a forecast of some development in the national or global economy involving the interactions of thousands or millions of individuals.

Even so, this forecast is more uncertain than the forecast that the rate of CPI-U inflation will drop. Political or economic developments might create opposing pressures and stay the hand of the Fed. This seems unlikely enough to me that investing in the expectation that interest rates will fall within a year makes sense.

The period of low rates should last awhile. CPI growth will likely prove tough to get back up above 2%, because the Fed has been busy trying to kill off the other sources of economic demand.

Less straightforward is the question of how far interest rates will come down. This is a much tougher thing to know, as it does involve an interplay with macroeconomic factors. I would not favor investing on the assumption that they will soon go back to zero.

One just cannot know. I hope they don’t go to zero, as to my mind this is not healthy.

How to Exploit the Opportunity

So suppose interest rates will move down rapidly, but to an unknown extent. We can know that rate-sensitive investments will move up a lot, but not precisely how much.

For such investments, it seems unwise to me to expect a return to the highs of early 2022 unless those highs were suppressed for a particular security. We could do a fancy model and make some prediction, but to my mind all of that would just be a complex way to make a guess.

My guess will be 50% recovery to the 2022 high price. [Ask a physicist for a guess of the value between zero and 1 that will be produced by a non-compounding system and that’s what you get.]

Bonds should respond well. But with the inverted yield curve long bonds do not have as much upside as one might prefer.

Even the AAA 2116 MIT bond only has an upside of 70% to its 2022 high. So my price target for it would be 35% upside from here. That is not bad, but as Fidelity is my broker it is not available to me.

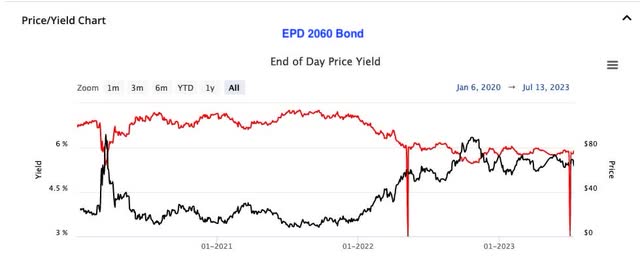

The Enterprise Products Partners (EPD) 2060 bond has 44% upside to its 2022 high and is available to me. Buying that one for a yield above 5% and targeting an upside above 20% would be sensible.

FINRA

There are likely other bonds from energy midstreams with similar potential. The common stock of energy companies in general, though, peaked in mid-2022 and has been roughly flat since. Only idiosyncratic plays for major upside exist today in that space.

Now let's look at REITs.

Divergence in REITLand

What I find most remarkable amongst REITs is how much divergence there has been in price action. Let’s consider VICI Properties (VICI) and Alexandria Real Estate (ARE).

These are both really great REITs. Both have solid balance sheets and excellent debt management. Both have grown cash earnings per share rapidly in recent years.

ARE is the only REIT solely focused on life science. Their mega campuses are uniquely valuable places to locate. Their governance is excellent. They win awards on their disclosures. Their VC arm adds value beyond their real estate operations. And their long-term total returns are among the best across all investments.

VICI has grown rapidly in recent years, achieving investment-grade status and becoming listed on the S&P 500. Their governance and disclosures are also excellent. Their disclosure of lease terms is better than Alexandria’s and they have unusually good escalators.

As I said, these are both great REITs. But here is their price action from the beginning of 2022 to now.

YCHARTS

Mr. Market has loved VICI, giving it gains when most REITs dropped (although the price today is 7% below the high set in the summer of 2022). And Mr. Market has hated ARE, driving it down more than 45%. This is all a lot more dramatic than what the bond markets have done.

We can return to this topic after looking more broadly at price trends across investment-grade REITs.

Perspective on Investment-Grade REIT Prices

I track the price movements of the 66 REITs that carry investment-grade credit ratings, along with some others. The median decline in this group since early 2022 is 27%, implying 37% upside to recover to the early 2022 price.

[A caveat about the credit ratings of S&P: Strangely, the NAREIT listings in REITWatch are not reliable. I began with a list that I think was reliable a couple years ago, and have made changes when becoming aware of them since. So please forgive and point out any errors.]

My view is that the median price decline reflects the change in discount rates associated with the increase in interest rates. All REITs should be impacted by this, even if other factors have led the market to increase their stock price, as has happened with VICI.

If one wants to plan on getting back half of the drop related to such rates, that will be 15% to 20% upside from wherever the price is now. That’s not bad, over a year or even two, especially when combined with a dividend yield of 4% or 5%.

In the abstract this should work for any REIT going forward. For my own part, though, rising prices make me nervous. Mr. Market tends to overshoot and that could limit forward gains for VICI and for other recent winners.

The most conservative approach would be to buy REITs whose drop is near that 27% median. An example is Essex Property Trust (ESS). No argument here against doing that.

It should work and produce modest gains. Likewise Federal Realty Investment Trust (FRT) would be a reasonable choice.

In contrast, my perspective is that we want to find the “losers,” in the sense that they have dropped the most from their 2022 high. Then we can ask whether Mr. Market had a good reason for dropping their price and whether he overdid it.

So here we go.

REIT Price Upsides

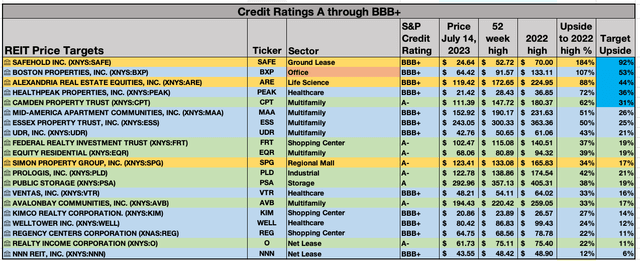

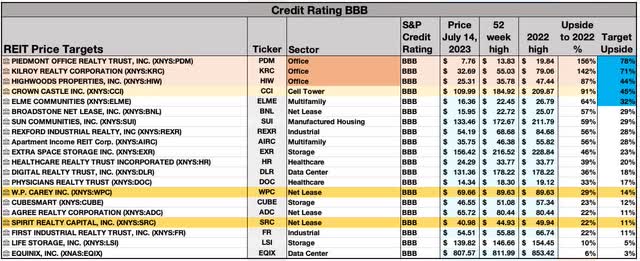

I applied the model suggested above to find a target upside for all of the REITs I follow (half of the return to the 2022 high). Here are the results for those rated BBB+ or higher:

RP Drake

I own three of these REITs, shown on rows shaded gold. Otherwise the BBB+ REITs are on rows shaded light blue and the higher-rated REITs are on rows shaded green.

In my way of seeing the world, these are the only “blue-chip” REITs. Nothing can compensate for a risky balance sheet.

Remarkably, Mr. Market values most of these REITs and has dropped them in price less than the median REIT. Perhaps he does value quality, at the moment.

Five of them have more than 60% upside to their 2022 high, though. Some comments about them:

- In my view Camden Property Trust (CPT) was overpriced in early 2022. Mr. Market fell too much in love with the sunbelt.

- Since I abstain from Healthcare REITs, if not from various sins in the eyes of the medical profession, I have nothing to say about Healthpeak Properties (PEAK).

- In my view ARE, the life science baby, has been thrown out with the office REIT bathwater. I own it for upside.

- My recent article on Boston Properties (BXP) detailed how things are better for them than I had thought. They escaped my target yield and are not in my portfolio, but still seem a reasonable play to me.

- Safehold (SAFE) is discussed further below.

Here are the BBB REITs:

RP Drake

Again I own the two in rows shaded gold, for income. There are only five here with more than a 60% upside to their 2022 high. Again, some discussion.

- The three office REITs, on rows shaded orange, each have their fans on SA. Personally, if I’m on the edge about BXP I’m not buying any of them.

- Crown Castle (CCI) just got more bad news (lead cables left in the ground by Verizon and AT&T), on top of other headwinds detailed in my recent article. Even before the recent news, the margin of safety for them seemed insufficient for me.

- After Elme Communities (ELME) screwed their shareholders (in my opinion) in their panicked rush to become a multifamily-only REIT, before changing their name, they have a long way to go to gain back my trust.

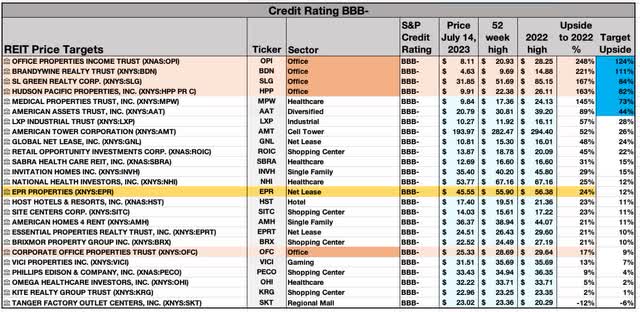

And to finish the collection, here are the BBB- ones:

RP Drake

In this group I hold only EPR properties (EPR), for income, for reasons discussed here. There are six REITs with an upside above 60% to their 2022 high. Comments on them:

- The four office REITs are a similar story to those in the previous group, though Office Properties Income Trust (OPI) seems to have few fans. Invest in any of them at your own peril.

- My view of the management of Medical Properties Trust (MPW) is extremely negative, which is an understatement. But I’m done spilling electrons on that one.

- American Assets Trust (AAT) has only a few fans. All I have to offer is that a REIT with more than half their assets in office properties and paying a 3% dividend yield in this market has less than zero interest for me.

So there you have it. There are lots of REITs to choose from if you want to target 20% to 30% upside as interest rates decline, along with some reasonable forward growth prospects and a continuing dividend.

There are only a few where you might decide that Mr. Market has overdone it and you want the resulting upside. From this perspective, I would select ARE and BXP. And also SAFE, which we discuss next.

Safehold Inc.

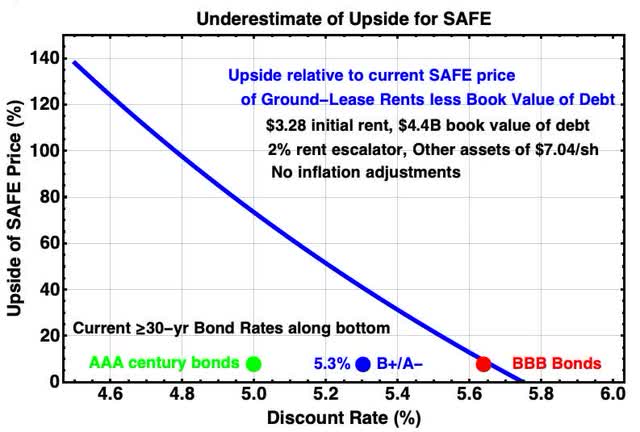

Safehold is a pureplay ground-lease REIT. Their ground leases have a 93-year, weighted-average, lease term. As a result, these leases have more in common with a century bond than with the leases of any other REIT.

The value of their existing leases, like that of century bonds, is extremely sensitive to interest rates. That value plummeted last year when interest rates soared.

In due course, a long article on Safehold today and its value will come from me. But here we will look at results from a simple model that assigns value only to the future lease payments from existing ground leases. I will show a curve of percentage upside relative to the current price.

The upside curve below leaves out many positive contributions that would push fair value up. Some of these are:

- The debt is valued at book value instead of the lower NPV.

- Likely future CPI-related adjustments are not included.

- The value of the property returned on lease expiration is not included.

- The portfolio growth is assumed to be zero.

The calculation modeled the existing portfolio based on its average properties. The initial rent per share is $3.28 and the annual escalator is 2%. The debt is subtracted at book value from the NPV of the ground lease payments. Here is the result:

RP Drake

The colored dots along the bottom show the current discount rates (and coupon yields) for bonds of 30 years or more duration. The corresponding credit ratings are indicated.

What you can see is that today SAFE is priced as though the Safehold ground leases have the safety of BBB bonds (and actually worse than that because of the omission of the other sources of value described above). The view of Green Street is that the Safehold ground leases should be valued like AAA century bonds, because of the extreme safety of their payments and the positive consequences of default.

Were a change in discount rate to the AAA-level to happen, there would be 70% upside without any change in interest rates. But that is not our focus today.

The AAA century bonds moved up 200 basis points in discount rate during 2022. A decline of 100 points from here would be no surprise.

Suppose that SAFE continues to be priced at the discount rate of BBB bonds, but that the yield of those bonds moves down by only 50 basis points. The value of SAFE would be ~60% larger.

A 100 basis point move would more than double the value of SAFE on this model. This is in the ballpark of the 91% upside seen in the table above from more simplistic arguments.

Now if you think Safehold will do things that destroy the value embedded in their ground leases, you should stay away. That is not a concern of mine.

Last week, when I got this far in my analysis, I sold a tranche of EPR that had given me a gain of 26% in four months, added a little cash, and bought SAFE. That new tranche is a 3% position.

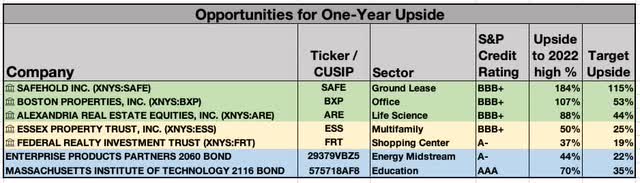

Summary of the Opportunities

Here is a table summarizing what I see as the good opportunities from the above discussion.

RP Drake

The first three rows (shaded green) are high upside REITs that I consider undervalued beyond just the impact of the interest-rate increases. These are the only places found here where one can hope and expect to beat the median market upside from REITs.

The next two (shaded tan) are very sold REITs that should grow steadily, pay their dividends, and appreciate with a decrease in interest rates. There are quite a few others in this category. Take your pick.

The last two rows (shaded blue) are the bonds discussed above. If the yield curve were not so strongly inverted, the long bond rates might have increased further and given us better opportunities. But we are not that lucky.

If you invest in this potential opportunity to benefit from falling interest rates, when should you exit? My recommendation: exit at the price target, unless you have other reasons to keep holding (such as anticipated long-term growth).

And if the stock does not hit the price target within a year after rates start declining my recommendation would be to exit. On longer timescales other macro factors will emerge that will change the future of interest rates from there.

"follow" - Google News

July 24, 2023 at 05:30PM

https://ift.tt/HusLvYU

REITs To Buy As Inflation Plunges And Before Interest Rates Follow - Seeking Alpha

"follow" - Google News

https://ift.tt/Cb5ncxJ

https://ift.tt/Oe86U4n

Bagikan Berita Ini

0 Response to "REITs To Buy As Inflation Plunges And Before Interest Rates Follow - Seeking Alpha"

Post a Comment