2023 Reporting Framework

Why have changes been made to the Reporting Framework for 2023?

The revisions to the 2023 Reporting Framework are based on signatory feedback. Following the 2021 pilot reporting year, over 1,700 signatories responded to our call for feedback. The responses encompassed feedback on the structure and content of the Reporting Framework, as well as on signatories’ experience of the Reporting Tool.

Overall, signatories signalled that the content of the 2021 Framework better captured their responsible investment activities compared to that of previous years. However, the feedback varied across modules, and between Asset Owners and Investment Managers, with some areas flagged as requiring attention or being less suited to specific signatory types. Moreover, signatories indicated that the time and resources required to report on the pilot Framework were high.

As a result, we took the decision to remove mandatory reporting on direct asset class modules for Asset Owner signatories on their internally managed assets, and streamline reporting on direct asset class modules for Investment Manager signatories, focusing on reducing reporting effort. The reporting effort was also addressed by improvements in clarity in wording, consistency by elimination of duplication, and improvement in applicability of indicators.

In addition, we have restructured areas of the Framework, like the Organisational Overview module and Policy, Governance and Strategy module (previously Investment & Stewardship Policy module), to improve clarity, minimise redundancy, and reduce its overall length.

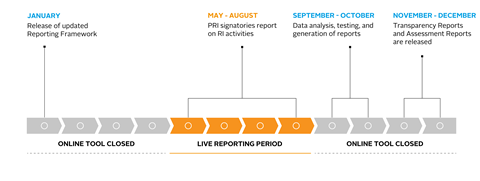

The full 2023 Reporting Framework will be published on our website by the end of January, providing signatories with more than 3 months to prepare for the 2023 reporting cycle before it opens in mid-May – extending the period available for preparation compared to previous years.

The changes to the 2023 Reporting Framework have been thoroughly considered and rigorously assessed to ensure that we can best service our signatories and deliver vital transparency to the market.

Likewise, the feedback received on the Reporting Tool is systematically being integrated into the scoping of functionalities for 2023. More information about how we have utilised feedback to improve our reporting platforms for 2023 will be shared in due course on our R&A Updates page.

Earlier this year, the PRI also announced that reporting for service providers would be paused in 2023. What is the rationale behind this decision?

We have taken the decision to pause reporting for service provider signatories until further notice, to focus time and resources on updating the service provider Reporting Framework specifically.

In 2021, PRI made significant changes to our Reporting Framework for Asset Owner and Investment Manager signatories and, due to the large volume of feedback received, this has been our primary focus to date. As such, the Reporting Framework for service providers has remained largely unchanged since it was fully implemented in 2018. Given the rapidly evolving landscape that PRI and our signatories are operating in, we have taken the decision to pause service provider reporting for the time being and to conduct a broader review of how we can best engage service provider signatories with the reporting process.

We know that the responsible investment landscape continues to change and we recognise the need for our reporting to keep pace with the realities of the industry. We believe that pausing reporting for service providers from 2023 will allow us to conduct the necessary work to ensure that the reporting process for service providers is meaningful and insightful – both for our signatories and for the wider industry. Our goal is to create a reporting solution for service providers that is fit-for-purpose and better reflects the current responsible investment landscape. We will keep you updated on any future decisions around how we propose to engage service provider signatories with this work and the reporting process.

When will service providers be able to report next? Do you plan to open reporting for service providers at all?

Reporting for all service provider signatories has been paused while we reassess the service providers’ Reporting Framework and conduct the necessary work to ensure that the reporting process for service providers is meaningful and insightful – both for our signatories and for the wider industry. We will update service provider signatories on the expected resumption of their reporting process in due course and once we have had time to conduct a thorough review process to ensure service provider reporting is optimised for our signatories.

What is the value proposition for service provider signatories without reporting in 2023?

Service providers continue to have access to the many resources available for PRI signatories, including but not limited to the PRI Data Portal, Collaboration Platform, speaker engagements and webinars, and content-specific papers published by the PRI, among others. In addition, the PRI lists all service provider signatories and the professional services they offer in an easily accessible public directory for investors to utilise.

By pausing reporting in 2023, our aim is to establish and deliver the best way to support service providers in their responsible investment journeys. We will keep signatories updated on any future decisions around how we propose to engage service provider signatories with the reporting process.

Can asset owners choose to voluntarily report on their internally managed assets through the direct asset class modules?

The full asset class modules, including all indicators (questions), will continue to be available as an open resource for signatories on the PRI website. However, Asset Owners will not report to the PRI on the direct asset class modules, nor will the PRI provide feedback and assessment on those modules.

On the decision to remove reporting on the direct asset class modules for Asset Owners’ internally managed assets, the PRI engaged with signatory feedback to streamline the reporting experience for Asset Owners as well as reduce the reporting effort. This has required restructuring elements of other modules, like the Organisational Overview and Policy, Governance and Strategy module (previously Investment & Stewardship Policy module), to continue to be able to capture relevant aspects of Asset Owners’ RI practices, such as their approach to stewardship and (proxy) voting policies. As a result of this restructuring, Asset Owners will not have the option to voluntarily report on their internally managed assets through the direct asset class modules.

As in previous years, where Asset Owners outsource their investment activities to external investment managers, they will still be required to report on their Selection, Appointment, and Monitoring of managers.

Will the assessment methodology be revised in 2023?

We believe it is important that the PRI’s reporting and assessment keeps up to date with the fast-moving changes in the responsible investment industry. Therefore, indicators may be added, modified or removed to reflect changes in the market which impact the indicator and/or module-level assessment, as well as the broader assessment methodology.

The indicator or module-level assessment may also be adjusted based on signatories’ past performance (e.g., to increase the challenge of high-scoring indicators/modules). We are cognisant of the changes made to reporting over the last few years, and will ensure any changes to the assessment methodology will be communicated with signatories well in advance of releasing reporting outputs and assessment scores. Our intention is to modify or update the assessment methodology only where there is evidentiary value in doing so.

How comparable will the 2021 and 2023 data be?

Changes have been made from the 2021 Framework with a view to address signatory feedback as well as to enhance clarity, improve applicability, and ensure consistency. Where there are indicator changes, they have been tracked to highlight which components of an indicator have changed, and this mapping resource will be shared with signatories to use as guidance for comparison across the two years. Where there are new indicators, the data will not be comparable, as this highlights new areas for signatories to showcase their progress in RI.

Reporting Timelines

Target timelines for reporting in 2023

What are the target timelines for reporting in 2023?

The 2023 Reporting Framework will launch by the end of January. This will include all modules, indicator-level questions, response options, indicator-level assessment criteria, and comprehensive explanatory notes with links to additional resources. The 2023 reporting cycle itself will open in mid-May and will close in mid-August. This will provide signatories with more than 3 months to prepare for the 2023 reporting cycle before it opens in mid-May – extending the period available for preparation compared to previous years.

When can signatories expect to receive their 2023 reporting outputs?

All 2023 reporting outputs, including both public and private Transparency Reports as well as confidential Assessment Reports, are scheduled for release in November 2023.

When can we expect to receive more information about reporting in 2023 and changes to the Reporting Framework?

We will continue to share more detailed updates about reporting in 2023 through our R&A Updates page on the PRI website. Please follow the page to stay up-to-date with the latest Reporting and Assessment developments.

We will share details of the most substantive changes, including the release of the 2023 Reporting Framework (by end-January 2023) directly with signatories via email.

The PRI has traditionally provided a one-year grace period with no required reporting and assessment to new signatories. Will this grace period change?

Signatories that would have reported voluntarily in 2022 will have their grace period extended to 2023. As in previous years, new signatories joining in 2023 will be provided with the one-year grace period.

Which year’s data will signatories report on when reporting re-opens in 2023?

As in previous years, signatories will be able to specify the 12-month period they report on. The reporting year may be the normal financial reporting year or a period that has been selected specifically for the purpose of reporting in the PRI Reporting Framework. Most signatories report on the most recent 12-month period and would, therefore, in the 2023 reporting cycle, report on their practices during 2022. We recommend that signatories keep the year-end date of the 12-month period they choose to report for PRI reporting consistent across years, to enable data analysis and comparison of scores across years.

Will future reporting cycles continue to take place from May to August?

At this stage, we expect the annual reporting cycle and process to remain stable across 2023 and 2024, though we cannot yet confirm the exact timeline for reporting in 2024. We can, however, assure signatories that they will be given ample notice ahead of an upcoming reporting period along with a minimum of 3-4 months advance notice to prepare using the full Reporting Framework, which will be made available on our website. Following the PRI in a Changing World Consultations with signatories, broader changes to reporting are in scope for 2025.

For any questions on the above updates, contact reporting@unpri.org.

"follow" - Google News

November 25, 2022 at 10:02PM

https://ift.tt/GeIA7uz

2023 reporting – SGM update follow-up | Reporting update - PRI

"follow" - Google News

https://ift.tt/VvEhM5w

https://ift.tt/bvEGZq2

Bagikan Berita Ini

0 Response to "2023 reporting – SGM update follow-up | Reporting update - PRI"

Post a Comment