hapabapa

Thesis

Dutch Bros (NYSE:BROS) is an interesting growth play with a potentially large market to address. However, I believe this is priced into the stock, making it a little expensive at current valuations. It also has an ownership structure that may put some investors off. Nevertheless, it could be a rewarding long-term investment if it can execute well and follow the playbook of successful companies that have been in a similar position.

Analysis

There is definitely a bit of hope priced into this stock, with some people probably hoping it will go the way of Starbucks (SBUX). I mean, Starbucks' playbook on how to generate fabulous returns for its shareholders is a nice one. I wrote about it in more detail here.

Build a brand + expand rapidly in the first phase, then return cash to shareholders through buybacks and growing dividends. It sounds simple in theory, but the real world is complex. And Starbucks has really focused heavily on China, which is a strategy that some people like and some people dislike. But I think international expansion plans are a bit further away for Dutch Bros at the moment. So they can focus on their growth in the US.

Dutch Bros Investor Presentation

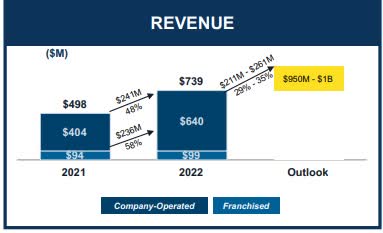

If we just look at revenue growth, they are doing quite well. Revenue growth of 48% in 2022 and guidance of ~30% in 2023 classifies them as a growth stock. But it will be important to see how they deal with the increase in ingredients due to inflation and how that will affect their growth plans.

Dutch Bros Investor Presentation

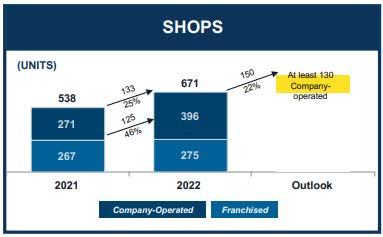

There's a good chance they'll have over $1 billion in sales and 800 stores by the end of 2023. Most of the new stores will be company-owned, as only old franchisees will be able to open new franchise stores.

At the moment, Dutch Bros' priority is to open new stores and profitability is a secondary goal. So how they choose their locations will be very important in their strategy. Expanding too quickly or building too many stores in close proximity to each other could lead to cannibalization. But it could also be the right thing to do, because there are cities where it feels like there is a Starbucks every 150 yards in the city center.

I think the first priority should be to try and build a brand. The Dutch Bros locations are well visited and it looks like they already have a small following, but a big part of the success story of Starbucks is that it is a lifestyle product where people post their coffee on their social media sites to paint a picture of their lives. The MacBook + Starbucks coffee picture could be one of the most popular pictures on Instagram.

Growth

95% of sales are beverages, of which 80% are chilled. Its Blue Rebel energy drink also accounts for 25% of net sales. And I think that could be an important part of the future. Energy drinks are highly addictive products where there is high brand loyalty and the opportunity to market them as a lifestyle product. Companies like Red Bull or Monster (MNST) have a huge following and a loyal customer base.

Establishing Blue Rebel as a competitor could really improve sales in my opinion and energy drinks have nice margins as they can be priced relatively high. Another area where they could see some nice growth is in gift cards, and this is an area that Starbucks has really mastered. Starbucks gift cards are one of the most popular gifts for birthdays and other occasions. And Dutch Bros is attacking that with their digital gift cards and their rewards program.

Valuation

If we look at traditional value metrics such as EV/EBIT, Dutch Bros is very expensive. Even if we take into account the growth potential, it is still far from cheap. But for stocks like Dutch Bros, this is not the right metric to use, and on a P/S basis it still looks expensive, but not as much as it used to. This is more of a story play, where you have to believe that they can get to 4000 stores and build an amazing brand.

The quality of management and a clear vision and path to implementation will probably determine whether this will be a success story or not. Companies such as Domino's (DPZ), Chipotle (CMG) or Starbucks have shown that it is possible to build a nationwide brand that has made a fortune for shareholders.

And I think that the management has shown at the moment that they are able to do that.

Risks

The complex ownership structure with A, B, C and D shares and the fact that the co-founders hold 75.9% of the voting rights may make this stock unattractive to many. In addition, there is the structure with Dutch Bros OpCo and Dutch Bros Inc, which could lead to conflicts of interest. The conversion of shares into Class A shares also means that there are probably more shares outstanding than most websites report.

The cash position and the 2022 credit facility are sufficient for the next 12 months according to the 10-K, but for me the position is a bit low and this could be a risk that could influence the growth plans.

On another note, I am not a big fan of the introduction of adjusted EBITDA figures. For me personally, adjusted figures are usually an attempt to sugarcoat a situation. I am not saying that this is the case with Dutch Bros, but adjusted figures are a red flag for me and I try to watch the next earnings releases to know why they have tried to do this.

Conclusion

As a small speculative position, I like the idea of Dutch Bros. They have everything in place that could lead to fabulous returns in the future, and they know that it depends on whether they can execute well enough. An entry position would probably be better in the twenties, but if you were going to hold this company for 10 years+ it really does not matter if your entry point is in the 20s or 30s as it would only be a small difference for a long term investment.

All in all, if you believe management can deliver, the high valuation should not put you off. But this is not a company that will succeed no matter what management does. A good or very good management team is essential to make this a successful investment in my view.

"follow" - Google News

April 13, 2023 at 03:50AM

https://ift.tt/aE8Yl4F

Dutch Bros: They Have To Follow The Playbook (NYSE:BROS) - Seeking Alpha

"follow" - Google News

https://ift.tt/Dl7jkVT

https://ift.tt/8bVTt3l

Bagikan Berita Ini

0 Response to "Dutch Bros: They Have To Follow The Playbook (NYSE:BROS) - Seeking Alpha"

Post a Comment