Warnings from United States Federal Reserve officials about the shakiness of the economic recovery from the coronavirus pandemic and a tumble on Wall Street pulled shares in Asia sharply lower on Thursday.

US Federal Reserve Vice Chair Richard Clarida said on Wednesday that the US economy remains in a “deep hole” of joblessness and weak demand, and called for more fiscal stimulus from the government, noting that policymakers “are not even going to begin thinking” about raising interest rates until the inflation rate hits 2 percent.

Cleveland Federal Reserve Bank President Loretta Mester echoed Clarida, saying that the US remains in a “deep hole, regardless of the comeback we’ve seen”.

MSCI’s broadest index of Asia-Pacific shares outside Japan tumbled 1.35 percent in the morning session on broad losses across the region. It is down about 3 percent from a more-than-two-year high reached late last month, but remains more than 41 percent higher than its levels in March as the virus took hold globally resulting in widespread economic shutdowns.

Chinese blue-chip shares dropped 1.09 percent, Hong Kong’s Hang Seng fell 1.72 percent, Seoul’s KOSPI sank 1.73 percent and Australian shares were 1.18 percent lower.

Japan’s Nikkei fell 0.74 percent.

‘Blood on the street’

Many analysts believe the rebound in share prices over the last six months is not fully justified by the underlying realities of the global economy.

“Have we overpriced the rebound in the economy? After the stern warning from Clarida, I say we have,” said Stephen Innes, chief global markets strategist at AxiCorp.

“I think the market was interpreting a bounce from the bottom as a cyclical recovery, but I don’t think we’re there yet. I still think there’s a lot of blood on the street, especially on Main Street.”

US stocks fell on Wednesday after data showed business activity slowed in September, with gains at factories more than offset by a retreat at services industries.

Investors now await weekly data due later on Thursday, which is expected to show US jobless claims fell slightly but remained elevated, indicating the world’s largest economy is far from recovering.

While Clarida and other Fed officials have called for more fiscal assistance in boosting the economy, analysts say immediate support is unlikely with the US Congress locked in an impasse.

Additionally, a second wave of coronavirus infections in Europe threatened the economic recovery in that region pushing equities lower and propping up the safe-haven dollar.

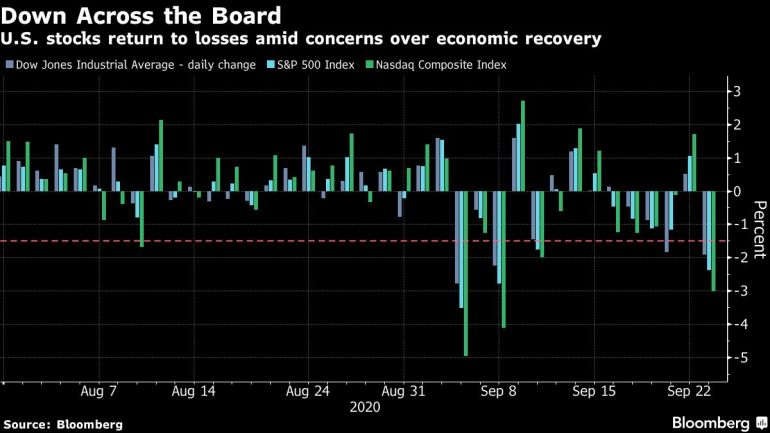

On Wednesday, the Dow Jones Industrial Average fell 1.92 percent, the S&P 500 lost 2.37 percent and the Nasdaq Composite dropped 3.02 percent.

[Bloomberg]

[Bloomberg]The euro ticked up to buy $1.1664.

“A stronger USD remains a significant headwind for commodity markets, with investor appetite waning,” ANZ analysts said in a note.

Spot gold – the price of the metal for immediate delivery – hit a two-month low early in the Asian day as the dollar appreciated, but was flat at $1,863.61 per ounce by mid-morning.

Oil prices fell amid uncertainty about demand due to pandemic-related travel restrictions.

Brent crude dropped 0.89 percent to $41.40 a barrel and US West Texas Intermediate crude was 1.15 percent lower at $39.48 a barrel.

"follow" - Google News

September 24, 2020 at 03:01PM

https://ift.tt/364FjwG

Gravity takes over as Asia stocks fall from highs, follow US drop - Al Jazeera English

"follow" - Google News

https://ift.tt/35pbZ1k

https://ift.tt/35rGyU8

Bagikan Berita Ini

0 Response to "Gravity takes over as Asia stocks fall from highs, follow US drop - Al Jazeera English"

Post a Comment